Credit Education Is Crucial To Establishing Your Credit Plan”

Don’t let credit report errors cost you in your financial matters, and be prepared to optimize your purchasing power when making large purchases, such as a car or home. A little education will benefit you for a lifetime. Clubco Direct has teamed up with “New Credit” to give members access to a helpful staff of credit advocates, education resources, and a growing collection of industry notes.

All three credit buearus gather an incredible amount of data on over one billion consumers worldwide. They don’t ask permission nor do they make it easy to manage the dispute process for credit reports.

They collect, aggregate, and sell consumer information. In 2017, one of these companies had a data breach that allowed the personal records of over 143 million people to be stolen.

Creditworthy Program with The “New Credit” Company

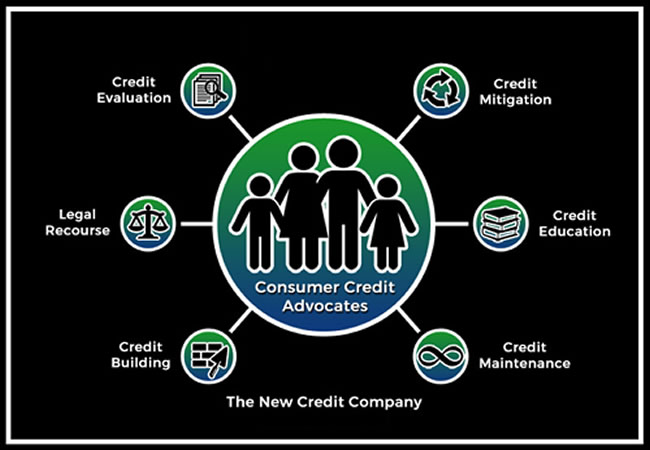

Credit Perfection: Consumer Credit Advocates Managing Every Negative Influence

Credit Education: Learn Your Best Credit Practices For Life

Credit Building: Perpetual Credit Increases to More Than You Need

Credit Protection: Managing Abuses & Errors

Loan Preparation: Know Your Status Before Applying for a Loan

Legal Recourse: Enforcing Your Legal Rights

Benefits of Great Credit: “Concierge” Access to New Credit Partners & Providers

Getting Started Is Easy

New Credit Services is available as a monthly subscription.

By purchasing a subscription, you agree to an initial and recurring subscription fee. The recurring subscription fee will be charged monthly on the date of your initial order. If you placed your initial order between the 25th and the 31st of the month, recurring payments will post on the 25th. You may cancel your subscription at any time.

Credit Services – Six Month Program: $99.00 per month

(typically 3 dispute cycles)

Credit Management Subscription: $19/M (continuous credit advocacy/building)

Questions?

Simply fill out your contact information and your Clubco Direct ID#.

- Credit Analysis for every client from all 3 credit bureau’s.

- Removes questionable and non-verified accounts from your credit report

- Average of 4 unfair remarks removed from credit report per cycle.

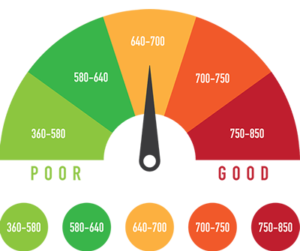

Credit affects every aspect of your life.

Unless you are independently wealthy and able to buy homes and cars with cash, you need credit. The better your credit status, the better terms for every dollar you ever borrow.

No credit is as bad as bad credit and can take many years to grow. You pay the most or fail to qualify for rentals, credit cards, new jobs, car insurance, mortgages, and more.

We begin with education and evaluation. From there, we develop and execute a strategic plan to help build a solid financial foundation that makes for greater opportunities and fewer debt and credit issues, for the rest of your life.

No… Credit monitoring involves researching the offering for sale of your personal data, with insurance to pay for any recovery after the fact. Credit monitors do NOT prevent identity theft. They warn you after confirming that your specific identity is being listed on the “Dark Web” (the underground Internet).

Let New Credit remove any doubt.

Your personal data, including name and social security number, have been stolen from one source after the next, throughout your life. We can all but guarantee that your data is available to any and all buyers through a volume of criminal elements, from lowlife individuals to organized crime syndicates operating online markets comparable to eBay.

New Credit manages everything on a long-term basis, from building credit to mitigating threats that pop up randomly (such as ID theft).

*Disclaimer: The New Credit Company

THERE ARE NO GUARANTEES. |

Federal Consumer Protection Laws, and likely most state laws forbid offering any guarantees for potential improvement to credit scores. But, we promise that our team will treat you like family, and deliver our absolute best effort to improve your overall credit status.

We fight hard to remove inaccurate and/or obsolete negative items from credit reports unless the law demands that they remain.

Complex cases with significant volumes of more difficult dispute efforts such as bankruptcies or child support cases may require a premium expense due to additional labor needs.

For those with a high number of negative items for attention may require additional dispute cycles for maximum results, for up to six additional months.

In all cases, where we recognize a need or benefit through our valued partners, we can manage introductions and/or the entire process (such as student loan mitigation or legal recourse involving Consumer Protection Laws).